Blog

How To Money or Deposit Canadian Checks In US Banks

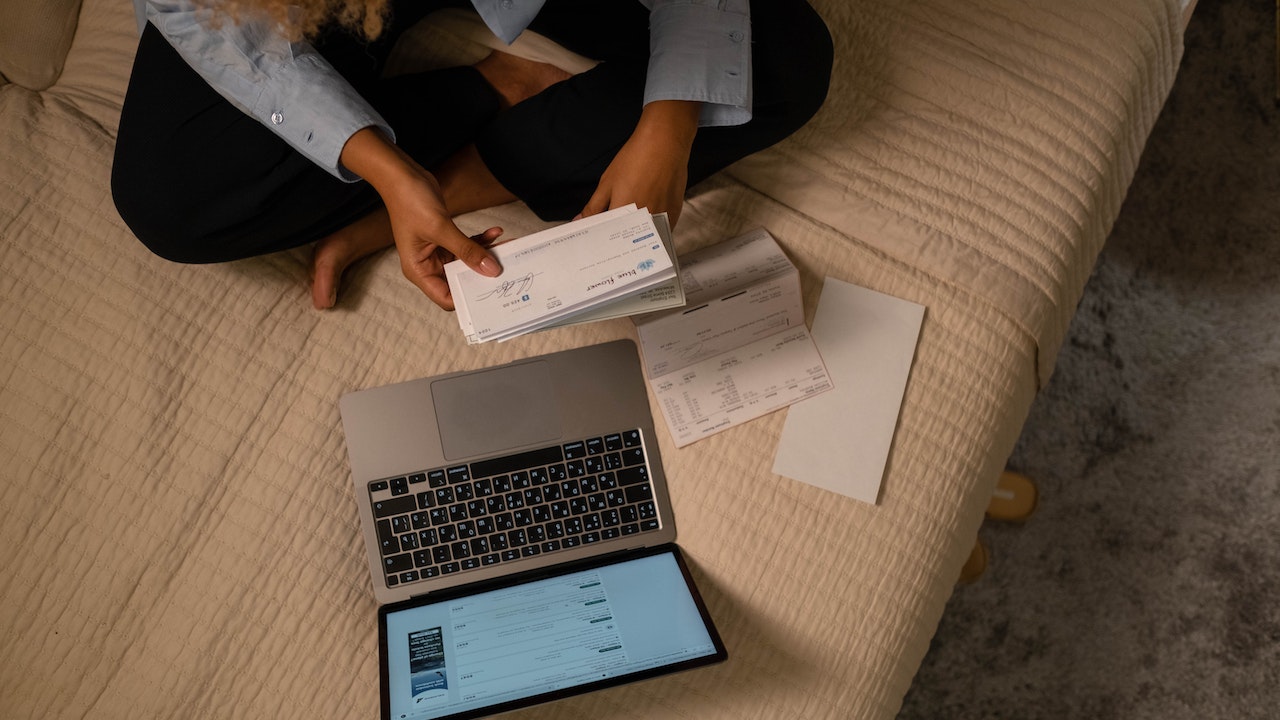

As a US resident, cashing or depositing a Canadian check may be complicated, given the catches and requirements.

To attenuate the chance of fraudulent activity, quite a few American banks opt to position a short lived hold on funds from Canadian checks. Subsequently, what are the steps to money or deposit Canadian checks in US banks?

With none delay, explore a scientific process for depositing or cashing a foreign check at a US bank. So, without further ado, let’s start!

MORE: 35 Check Cashing Places Near Me: Places to Money Check

Cashing a Canadian Check – Every thing You Must Know

We will simplify the cashing and depositing process by dividing it into just a few distinct steps. Nonetheless, before we proceed further, let’s start with the fundamentals.

Directly Cashing the Check

The present policies render you unable to money out or deposit a Canadian simply. To make use of a foreign check, you will want to deposit the check into your checking account. You possibly can only withdraw the cash out of your check after depositing it in your checking account.

Considering the necessity to deposit the check, you’ll be able to process a Canadian check only at a bank where you’re a customer.

While cashing out the check normally requires you to bring a government-issued ID and a check, the requirement may vary, depending in your bank. Hence, confirming the required documents before going to the bank can be clever.

Hold Times

While you clear a Canadian Check, the bank will take a while to process the check before transferring the quantity to your account. The bank takes this time to confirm the authenticity and perform all formalities, and it is known as “hold times.”

There are two ways of clearing Canadian checks: Check collection and Negotiation. Each these processes have different hold times.

Check Negotiation

Check Negotiation is the perfect process to clear a Canadian Check. Following this process, the bank takes roughly 3-5 business days to process the funds.

Check Collection

Check collection, alternatively, could be a lengthy process. The bank may require 3-6 weeks to process your funds, depending on the formalities it needs to meet.

During a check collection, the US bank will send the check to the originating back for verification. Nonetheless, check collection is usually triggered if you deposit a check for a bigger amount than normal.

Processing Fees

Processing a Canadian check causes the US banks to require running some processes, leading to incurring costs. In turn, the bank makes itself whole by taking the fee money out of your pockets and calling it the “processing fee.”

The processing fees for clearing a Canadian check may vary from bank to bank. Subsequently, before you clear a check along with your bank within the US, it’s crucial to inquire concerning the processing fee. Knowing concerning the processing fee will aid you understand your check’s total amount reduction.

Inquiring concerning the processing fee beforehand can even aid you compare the fees being charged by the opposite banks. Although it is going to require you to open a brand new account, going with a bank with a comparatively lesser fee will will let you avoid wasting money.

Exchange Rates

While you deposit a Canadian check in a US account, they may pay you the quantity in American currency. Since American Banks have little interest in Canadian Dollars, they convert the quantity into US Dollars before paying you the quantity.

In response to the Federal Reserve, the present exchange rate between the US and Canada is 0.7355. Nonetheless, your chosen bank will not be legally obliged to make use of this conversion rate. Subsequently, when inquiring concerning the processing fees, it is usually crucial to inquire concerning the exchange rates the bank will give you.

Conclusively, you want a bank offering the most effective exchange rates and lower processing fees.

Using Canadian Banks in America

The perfect option is to make use of the identical bank to cancel out some fees and make the procedure go faster. If the Canadian Bank through which the check has originated is present within the US, you must select them.

Processing your checks through them could make the method much simpler and mitigate just a few processing fees.

Below are just a few American banks with branches situated in Canada:

Having its branches situated in Canada, the Bank of America lets you money or deposit Canadian checks at no fees! They use their conversion rates when processing Canadian checks. Nonetheless, the hold time will differ, based on multiple aspects, corresponding to the quantity.

The Bank of America, nonetheless, restricts you from depositing Canadian checks via ATM or through your smartphone. It’s essential to visit any bank branch and deposit your check with a teller.

While Chase Bank provides the service of cashing and depositing the Canadian check, it comes with a catch. Their service for cashing checks is simply available at just a few branches. The rates also vary depending on the shopper and transaction.

Chase Bank also has a limitation to processing the check provided that the USD amount of the check is the same as or lower than your account’s courtesy limit. Generally, the courtesy limit of a Chase Checking account is $5000. Additionally they may charge you a commission fee or every other costs incurred through the process.

The estimated hold time for clearing checks through Chase Bank may be as much as Six Weeks. So, call them to inquire concerning the branches allowing you to money the Canadian Checks and select the one closest to you!

The HSBC bank is an alternative choice for Money or Depositing a Canadian Check. They charge you for any cost incurred by the bank while adjustment of the check. As for the conversion rate, HSBC converts the cash depending on the deposit rate.

HSBC states that you simply will probably be solely accountable for all exchange risks. Nonetheless, requesting HSBC to process the check on a group basis may help nullify this risk. While you should have to pay any applicable fee, it might probably aid you attain peace of mind.