Blog

UK Inflation Falls – MoneyMagpie

Reading Time: 2 minutes

UK inflation falls

UK inflation fell to eight.7% within the yr to April, latest figures show. That is down from 10.1% in March, reaching single figures for the primary time in eight months. Although this has come as a relief for a lot of, inflation remains to be barely concerning the 8.2% figure forecast previously.

Nevertheless, attributable to food prices within the UK continuing to soar on the fastest rate for 45 years, inflation is falling more slowly than analysts expected. Currently standing at 19.1%, food inflation is near breaking records for the speed at which it’s rising.

Inflation lowering is sweet news. Nevertheless, it doesn’t mean prices are declining – it simply means the speed at which prices are rising is slowing. Inflation measures the speed at which costs go up – not the prices themselves. It might take a couple of months for lower prices to be reflected on supermarket shelves.

Based on the information from the Office for National Statistics (ONS), although vegetables equivalent to potatoes are dearer than this time last yr, many staples have fallen in price. These include food shop regulars like bread, fish, cereal, eggs and milk.

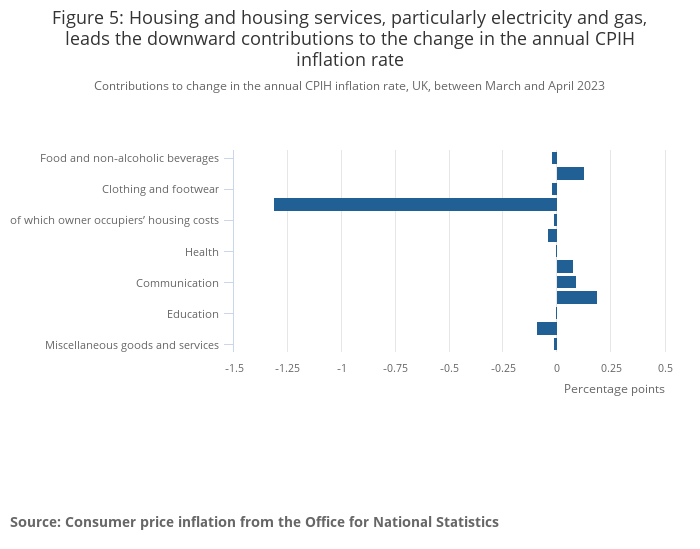

The associated fee of housing and housing services has slowed, contributing greatly to the decline within the inflation rate. Similarly, the worth of gas and electricity have been a driving force in overall inflation dropping.

Commenting on the most recent inflation figures, Chancellor Jeremy Hunt said:

“Even though it is positive that [inflation] is now in single digits food prices are still rising too fast. We must stick resolutely to the plan to get inflation down.”

Ian Stewart, chief economist at Deloitte, said:

“UK inflation is past its peak, nevertheless it is proving stickier and more embedded than expected. Rising levels of core and repair sector inflation highlight the danger that domestic inflation pressures persist, whilst the shock fades from high energy costs and other commodity prices.

“With growth holding up and recession fears easing, the scene is about for an additional rate of interest rise next month, and maybe a minimum of another before the top of the yr.”

You could find the total release from the ONS here.